Despite COVID-19, ocean freight carriers in Taiwan are bringing extraordinary returns to investors. All indications in early 2020 predicted that ocean carriers would lose demand and profitability, with a 20% plunge in volume in the first half of 2020. These indications proved not to be accurate.

Taiwanese ocean carriers tripled share prices for investors and boosted their profitability to unprecedented levels. While 2020 was a surprisingly bullish year for ocean carriers, technology advancements will be a critical ingredient needed to help them achieve and exceed investor expectations in the future.

Carriers’ exceptional revenue in 2020 is an opportunity for them to create sustainable profitability and competitiveness by investing in freighTech in 2021. Carriers such as Maersk have already leaped ahead and are becoming more tech than freight in the freighTech equation. Maersk has also invested hundreds of millions in tech startups that can help their strategy. Taiwanese ocean carriers now have the opportunity to build, buy, or acquire technology to match-up with Maersk.

You can sum 2020 up as a banner year for carriers. During the COVID-19 pandemic, ocean carriers could ‘tailor supply to demand on a tactical level’ with blank sailings and extra loaders.

Additionally, carriers that deployed digital spot markets like Maersk were able to price space dynamically according to supply and demand. This was a game-changer in achieving revenue optimization.

With that said, container and equipment shortages limited carrier abilities to truly maximize their earnings this year. As rates might have risen, ocean carriers were unable to allocate their assets effectively. As such, the next wave of technology will likely look to address asset allocation.

Taiwanese Ocean Carrier Share Prices Hit Records in 2020

By the end of 2020, the market value for Evergreen Line, Yang Ming Marine, Wan Hai, U-Ming Marine, Taiwan Line, and Wisdom Marine grew by 265% to $14.628 billion from $5.52 billion in 2019. For some perspective, between 2018 and 2019, this figure only grew by 7%.

Between 2019 and 2020, Taiwanese ocean carriers each made some very substantial gains, and include:

- Evergreen Line - Increased share prices by 350% ($1.835 billion to $6.730 billion)

- Yang Ming Marine - Increased share prices by 454% ($549 million to $2.495 billion)

- Wan Hai Lines - Increased shared prices by 285% ($1.346 billion to $3.847 Billion)

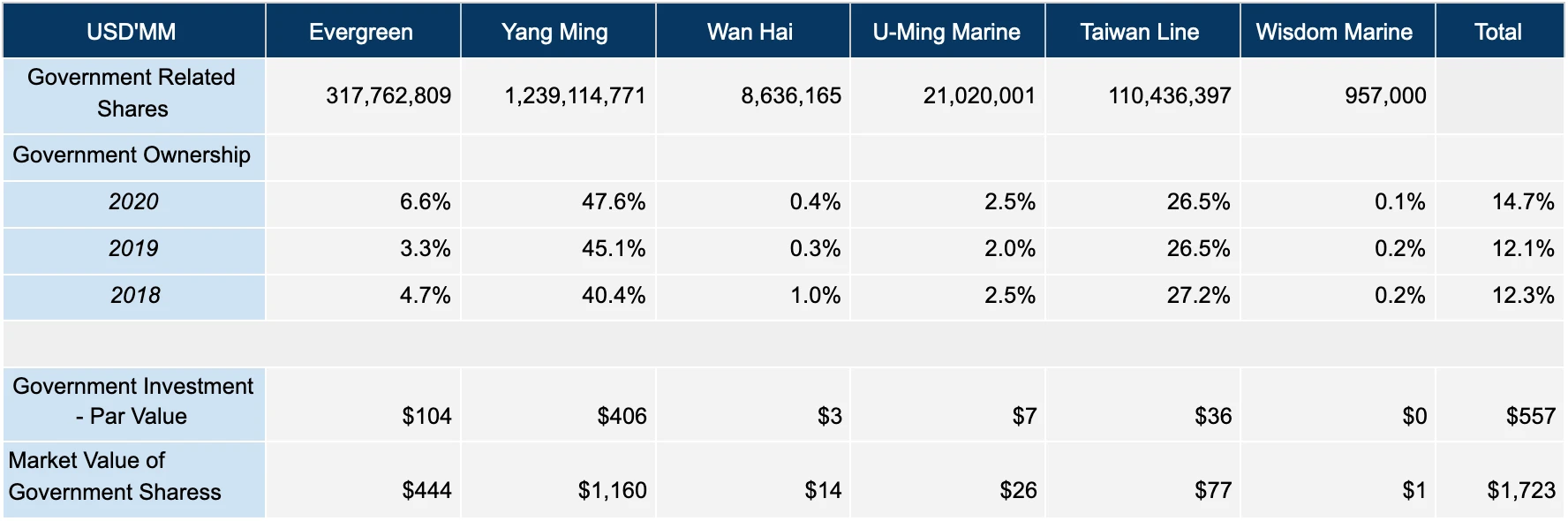

Likewise, the percentage of Taiwanese governmental investment and ownership in ocean carriers increased from 12.31% in 2018 to 14.7% in 2020, with their market value of shares increasing to $1.723 billion, a 309% increase from their initial investment value of $557 million.

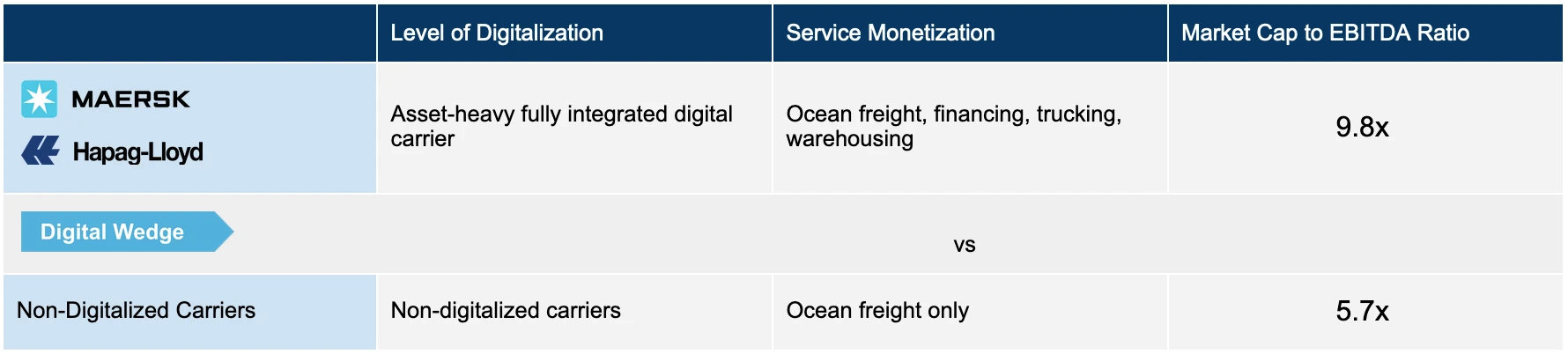

These new share prices come with greater expectations. Ocean carriers need to build, buy or acquire in digital to ensure sustainable growth in the future. Since 2017, Maersk has led the vanguard with Hapag-Lloyd to revolutionize ocean shipping via digital transformation. Taiwanese carriers have an opportunity to match up with their recent windfall.

Maersk is becoming a freighTech-based enterprise, with a heavy emphasis on the tech. They already employ 6,000 software engineers, data specialists, and other IT professionals, and since 2017 have invested heavily in their asset-heavy ecosystem to effectively provide door-to-door solutions with analytical data they need to match supply and demand and customers with in-house and partnered logistics services.

Their online booking platform, Maersk Spot, accounts for 53% of their short-term bookings alone. Even before COVID-19, digitalized ocean carriers drove almost two times more shareholder value than non-digitized carriers, and 2020 has only bolstered their efforts to digitalize further.

On that note, Maersk has also invested heavily to solve their asset allocation problems. Investments in container tracking solutions like Traxens and global mobile networks like Onomodo will pave the way for them to be a leader in real-time container tracking.

While Taiwanese ocean carriers made strides in 2019 and 2020 to digitally transform, they now have the opportunity to protect their future market value through freighTech.

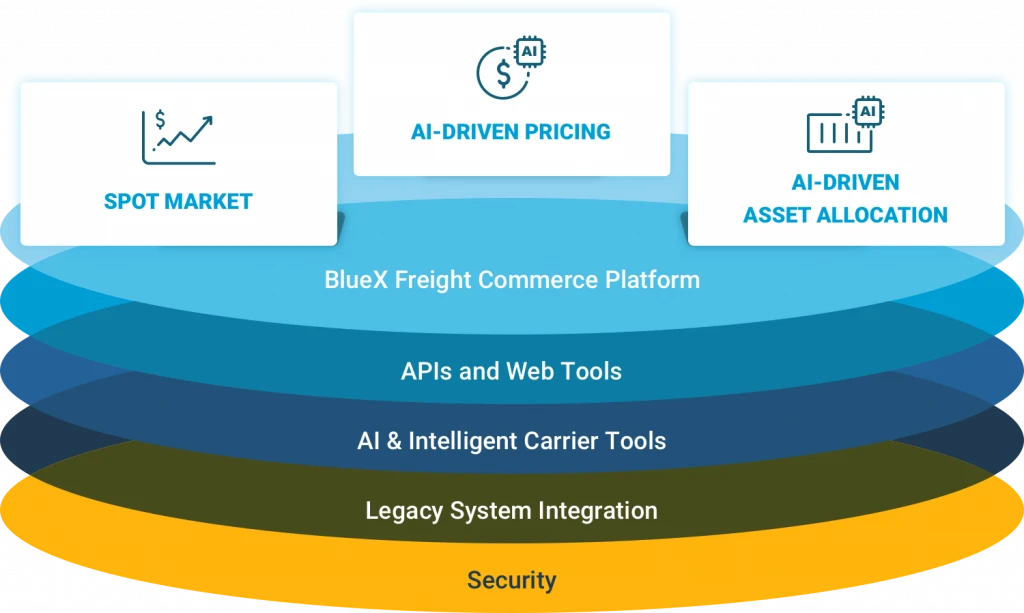

Like Maersk and other ocean carriers, Taiwanese ocean carriers need to strategically invest in digital spot and contract market solutions with AI-driven dynamic pricing and asset allocation to manage rate and inventory to maximize profitability effectively. Such a move can safeguard market value and create sustainable competitiveness in an ever-growing technically savvy industry.

BlueX has the FreighTech Taiwanese Ocean Carriers Need

BlueX partnered with several Taiwanese ocean carriers to provide scalable freighTech via our White-label E-commerce Solution and API integration with third-parties such as TMS providers and freight forwarders.

Our solution reduces ocean carrier risks while giving them access to world-class digital resources with the ability to scale their operations digitally on a proven platform. Likewise, our AI can give ocean carriers the competitive edge they need to effectively capture revenue by matching supply and demand with predictive analytics.

Building in-house freighTech solutions and systems are costly. We at BlueX give ocean carriers the tech they need to join the future landscape in the post-digital reality that’s coming after COVID-19.