From a financial perspective, the first half of 2023 will probably be remembered for the cascade of bank collapses that shook the economy: Silicon Valley Bank, First Republic Bank, and Signature Bank. While federal regulators are working to control the damage, many small to medium-sized businesses that survive from quarter to quarter or even month to month are facing even greater financial uncertainty than the year before.

- On March 10th, Silicon Valley Bank (SVB) was shut down by regulators in California. Though there were multiple factors, the main reason was that its investments had greatly decreased in value, leading depositors to withdraw large sums at once.

- On March 12th, just two days later, Signature Bank was closed down after account holders withdrew large sums of money following the collapse of SVB.

- On May 1st, First Republic Bank (FRB) became the second-largest bank collapse in U.S. history when most of its business was sold to JPMorgan Chase after it was seized by federal regulators. The main cause was a cascade effect of runs on deposits produced by the closing of SVB and Signature Bank.

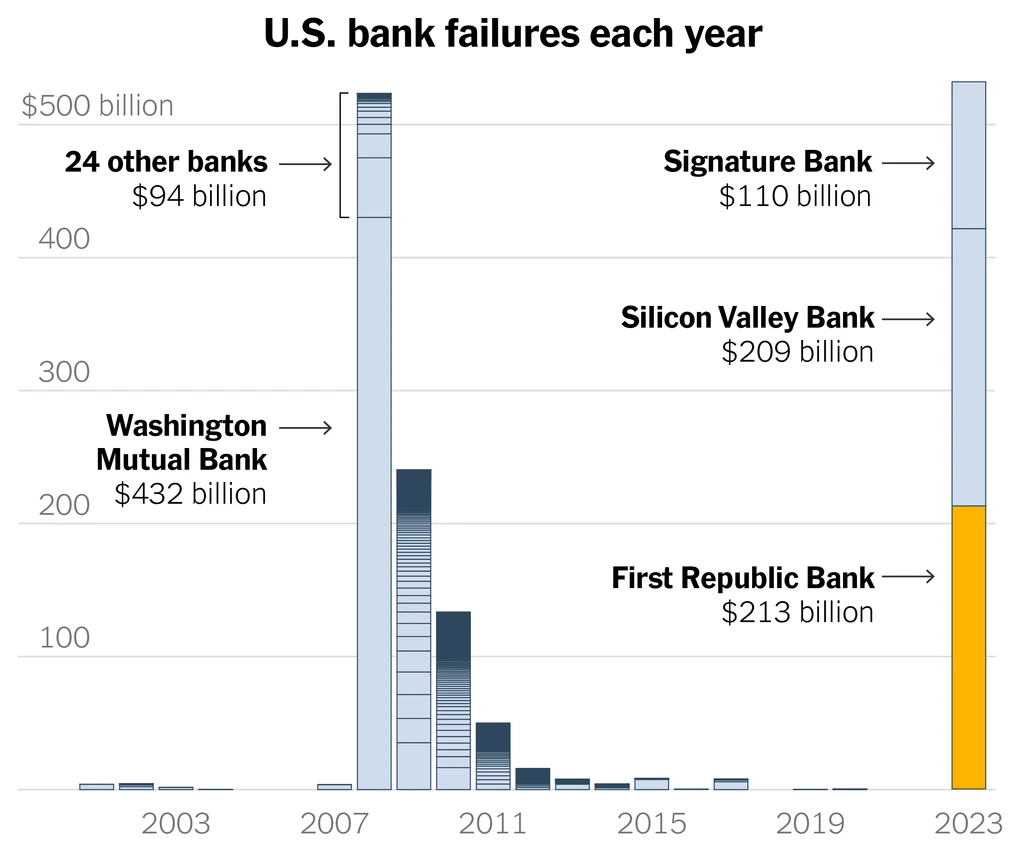

- According to the New York Times, the three banks combined held more in inflation-adjusted assets than the 25 U.S. banks that collapsed in the financial crisis of 2008.

Source: New York Times via data from Federal Deposit Insurance Corporation. (Adjusted for inflation)

Source: New York Times via data from Federal Deposit Insurance Corporation. (Adjusted for inflation)

If you are a small to medium-sized business in the U.S., you may already be feeling the effects of the bank collapses on your cash flow, which can include:

-

Temporary loss of access to insured funds: Businesses that relied on one of the three closed banks may temporarily lose access to insured funds until they are returned by the Federal Deposit Insurance Corporation (FDIC).

-

Bank stress and tightening credit: According to the Federal Reserve’s latest quarterly Senior Loan Officer Opinion Survey (SLOOS), lenders are tightening standards in the wake of the banking turmoil. Close to 50% of banks surveyed said that lending standards were slightly more stringent to small businesses compared to January of this year.

-

Another interest rate rise: In late March, The Federal Reserve decided to raise rates by 0.25% even while the banking collapse was happening. This has also led to higher interest rates on business financing in the short term.

Prioritize a healthy balance sheet over growth: In these times of economic disruption, focusing on the fundamentals of cash flow management and maintaining a healthy balance sheet should sometimes take precedence over business growth. You can consider pausing plans to grow your business and instead look at how to keep capital stable in the long-term beyond just this month or quarter.

Digitize your AR: Moving your legacy AR processes onto a digital platform at this timing is not just helpful, it’s essential. Such platforms are shown to greatly improve invoice reconciliation, reduce days sales outstanding (DSO), and increase overall visibility and efficiency in the payment process. If you’re not able to see all of your payment data in a single window, maintaining long-term visibility over your capital will become increasingly difficult.

Inventory financing or A/R factoring: There are more and more creative ways to finance your business besides credit cards and bank loans. If you are a retail business that struggles to purchase the stock you need for seasonal demands, you can consider inventory financing, which is using the inventory you need to buy as collateral for itself. Or, businesses with credit histories too short to get loans can try accounts receivable (A/R) factoring, or selling your invoices to a third party company for an advance on a portion of the invoice value. You can contact BlueX Sales for more information about our related solutions.

Use Pay-it-Later to maintain strong cash flow: Just by giving you more time to pay, B2B Pay-it-Later (PIL) solutions can help to offset rising supply costs and help your business acquire more inventory. B2B PIL is an ideal solution for companies looking to modernize their payment systems, reduce costs, and improve their competitive advantage.

For example, BlueX Pay-it-Later offers pay-later options for your cargo and all your logistics invoices, providing financing options with up to 100% of net invoice value and up to 1 million in funds available in 48 hours. BlueX will pay your vendor on time, and you can choose between net 30/60-day terms every time you submit an application. Moreover, BlueX supports different payment methods, including offline remittance, same-day ACH, and SWIFT.

To learn more, contact the BlueX sales team at sales@bluexpay.com