Most small businesses, particularly those that import from or ship to customers overseas, will encounter a shortage of working capital at some point. In fact, it has already become the norm, with statistics showing more than half of US small business owners have less than $5,000 set aside for financial emergencies.

Thankfully, there are a variety of financing options available to keep your business moving during those tighter times. But have you heard of inventory financing? This is a relatively new approach to maintaining cash flow that brings a host of advantages, especially for high-volume businesses such as retail, food service, or wholesalers.

To put it simply, inventory financing refers to using the inventory you need to purchase as collateral for itself. Sound confusing? Let’s break it down through an example.

Let’s say that you are a mid-sized retailer of high-end exercise equipment in Seattle. You purchase your inventory from a vendor based in China. The new year is always your busiest season, as customers want to get rid of all that weight gained over the holidays. In order to meet demand, you need to buy an especially high amount of inventory ahead of January.

The problem is: you don’t have enough capital to cover the cost of this inventory, and you’re not too keen to stake your house or car on a bank loan in the event your customers have sworn off exercise and you can’t unload all your stock.

The solution? You put up the inventory you wish to buy as collateral for the purchase itself to ensure you have ample stock. You don’t have to pay back the lender until after you sell off all your inventory. Or, in the worst-case scenario where you don’t sell all your stock, the lender can simply take the remaining inventory and sell it themselves.

That’s inventory financing.

There are multiple situations in which you might choose inventory financing to keep up your cash flow:

- You’re stocking up on inventory ahead of a busy season (as described above).

- You want to diversify your offerings but need capital to order new products.

- You need access to capital that is tied up in your inventory.

- You need more inventory to keep up with customer demand.

While the concept of inventory financing is pretty straightforward, there are different kinds for different situations:

1 ) Inventory Loan: A loan based on the cost of the inventory in question, usually between 50 to 90% of the inventory’s value, paid back in fixed monthly payments or a lump sum after all the inventory is sold. There are two types of inventory loans:

- Loan for inventory, where the inventory is used as collateral but the loan still requires a down payment, meaning the interest rates will follow the industry benchmarks.

- Loan against inventory, or a short-term loan as a specific percentage of the inventory’s value. If the borrower defaults, the lender takes the inventory and sells it.

2 ) Inventory Line of Credit: A financing method that can provide your business with an ongoing source of extra capital as you need it, which is good if you frequently have unpredicted expenses.

3 ) Warehouse Financing: The borrower transfers all of the inventory being used as collateral to a warehouse and the lender has some control over the movement of goods. Best suited to manufacturers or commodity businesses that sit close to their supply chains.

4 ) Inventory Factoring: The lender discounts purchase orders to buy the inventory to meet these orders. This only works for businesses that have a stable and robust sales cycle for their products.

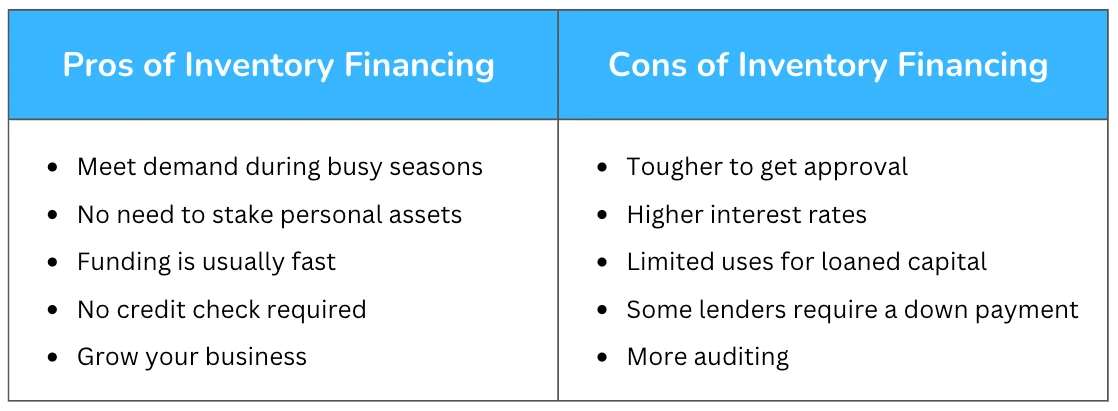

- Meet demand during busy seasons: Maintain your good business reputation by delivering on the products your customers want.

- No need to stake personal assets: Knowing assets such as your house or car won’t be lost in the event of a loan default gives you much greater peace of mind.

- Funding is usually fast: Inventory financing involves limited paperwork and a loan can be approved within one to two weeks of applying.

- No credit check required: Lenders who have your inventory as collateral won’t worry much about your credit history.

- Grow your business: Inventory financing can be especially helpful to businesses looking to expand their offerings. It’s also good for newer businesses since only six months to a year of operation is needed to qualify.

- Tougher to get approval: Though the process is fast and requires no credit check, getting approved for an inventory loan is still not easy. Lenders need to evaluate the chances of selling your inventory if you default, as the value of goods can depreciate.

- Higher interest rates: Rates are usually higher than other financing options as lenders need more security beyond seizing inventory, which could go down in value between the beginning and end of the loan period.

- Limited uses for loaned capital: Funds can only be used towards inventory and not other operating expenses, such as payroll or shipping.

- Some lenders require a down payment: The minimum amount could go as high as $500,000, which might be difficult for some businesses to put up.

- More auditing: lenders may engage a third-party auditor to check in on the status of your inventory frequently and how much has been sold or unsold.

The state of your inventory has a big impact on working capital. If you are looking to improve your cash flow, and feel that inventory financing is not the answer, BlueX Pay’s Cargo Pay-it-Later might be a better solution. BlueX Pay helps you to pay suppliers when you need it to keep your cash flow steady and grow your business. We offer a cross-border solution with:

- Up to $1M in invoice payments

- Up to 100% of the net invoice value

- Collateral-free financing

BlueX Pay is especially ideal for retailers or importers working with vendors based in Asia, due to our established relationships with local freight forwarders, carriers, and manufacturers throughout the region. We also offer bilingual customer support to make your overseas logistics work even easier.

Interested in trying it out? Sign up now: https://www.bluexpay.com/pay-it-later/