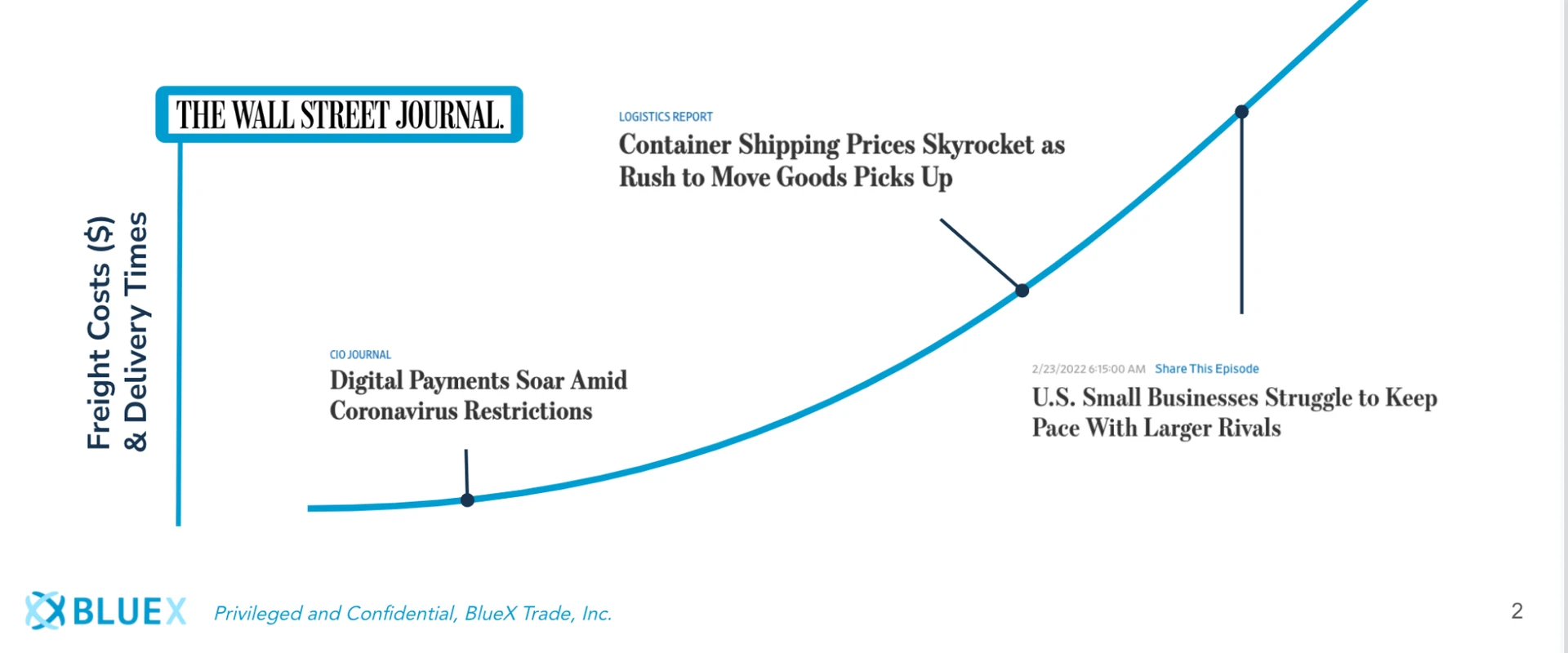

Small and medium-sized enterprises (SMEs) – which can include both importers and exporters, BCOs (Beneficial Cargo Owners), and shippers – are at a significant disadvantage when facing the logistics challenges of 2022. As SMEs become increasingly dependent on international trade, they in turn become far more vulnerable to disruptions in the current global freight environment.

The rise in trade volatility is requiring SMEs to figure out how to adapt. Recent events such as COVID-19-related lockdowns, port labor disputes, rising inflation, and geopolitical conflicts like the war in Ukraine, all pose unprecedented threats to the logistics world. SMEs currently lack the established infrastructure and financial safety net of large international companies, meaning disruption from one of the above issues could easily knock down the stability of their business. These global issues are raising unique challenges for SMEs who move goods internationally.

Freightos Baltic Index (FBX) shows that while rates are lower than the level that they were at this time last year, they are still several times higher than the pre-pandemic norm.

Environmental regulation, while an extremely positive trend for the high carbon freight industry overall, will also be a factor in higher shipping rates. The International Maritime Organization (IMO) has mandated a carbon intensity reduction of 2% per year between 2023 and 2026, with a long-term target of a 40% reduction by 2030. According to market sources, these higher efficiency targets will result in slower cargo times and a limit in de facto container capacity by 3-5%, as lower emissions require lower speeds, which in turn means higher freight rates.

Even more disheartening is the fact that while freight and shipping prices are lowering overall, they are unlikely to drop to pre-pandemic levels any time soon, creating more financial uncertainty for SMEs amid the recent inflation. According to a report from Fintech company Wave, one in three US small business owners were concerned about inflation impacting their business financially in the year ahead.

These increasing prices to transport goods to other countries often take a huge bite out of SMEs’ already limited business capital and create potentially unmanageable burdens.

As mentioned above, one of the biggest challenges for SMEs is limited cash flow in the face of unexpected disruptions to their business. The Wave report showed that 57% of US small business owners surveyed have less than $5,000 set aside for a financial crisis, while 48% said they would be unable to pivot to additional revenue streams in the case of such an event.

Extended delays in cargo release also serve to exacerbate the problem. What’s more, payment delays for cross-border transactions bring added complications when compared to domestic exchanges, as they tend to be longer and disputes are far more difficult to resolve, which could stretch an SME’s already thin capital to the brink.

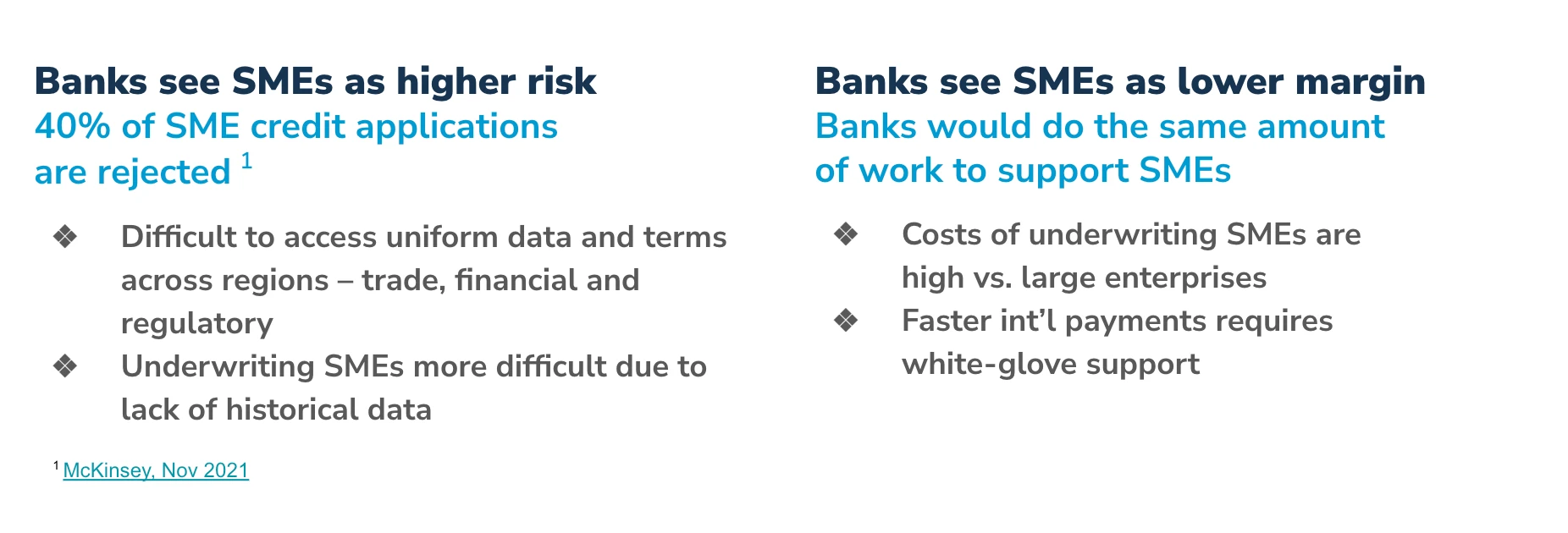

However, even as SMEs’ cash flow challenges increase, their financing and payment services options from banks remain limited.

Even though SMEs contribute up to 70% of global GDP, data from McKinsey still points to a $1.7 trillion SME trade financing gap, with 40% of SME credit applications being rejected.

This gap can be largely attributed to the fact that it’s easier for banks to do business with large size companies, for a variety of reasons.

To begin with, SMEs are seen as posing a higher risk to banks due to the difficulty in accessing uniform trade, financial, and regulatory data across regions. Underwriting SMEs is also much more challenging as they lack the historical data of larger enterprises.

From a bank’s perspective, SMEs are also a lower-margin business – it would require the same amount of work to provide financing support to a small business but result in lower earnings when compared to a large-sized client. Providing faster cross-border payments for SMEs would also require more white glove support.

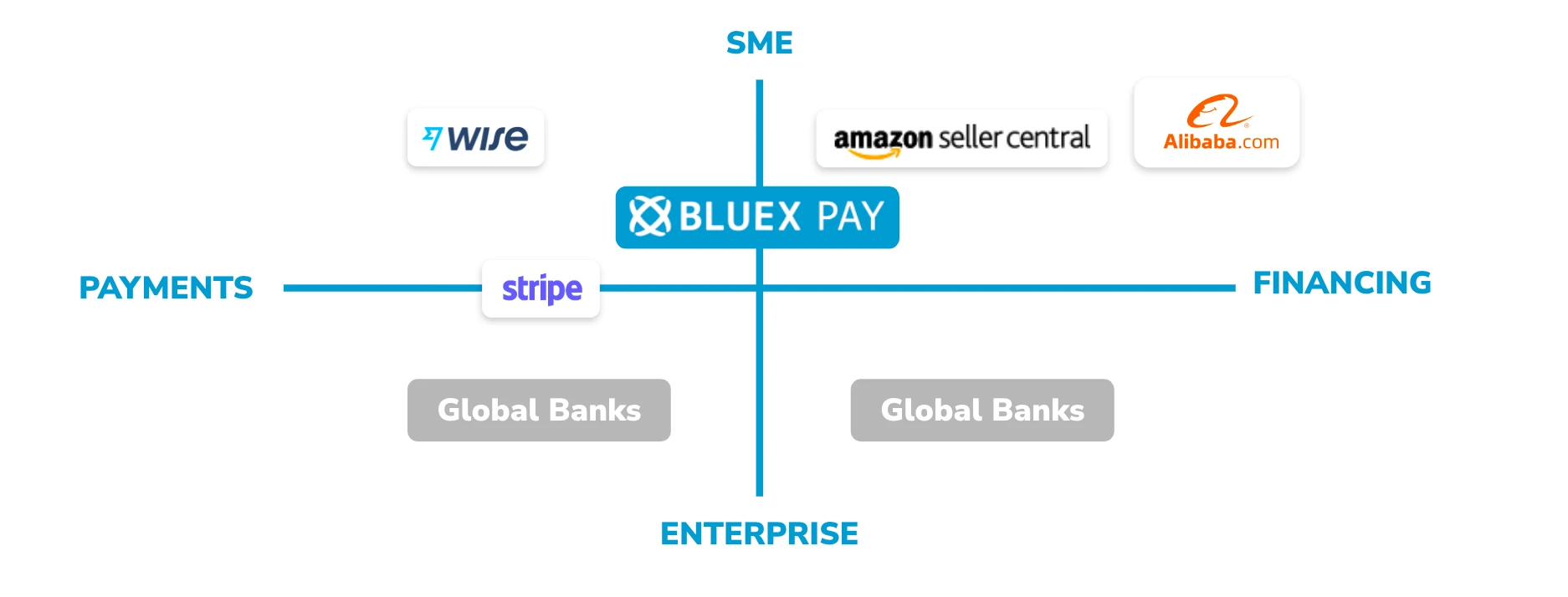

To weather the logistics challenges of 2022, SMEs must have access to flexible financial solutions. While we are seeing more banks adopting the kinds of digital tools that would allow them to better service SMEs, it is unlikely traditional banking practices will evolve soon enough to serve as the first lifeline. Rather, they will form one component of a new fintech ecosystem.

Supply Chain Finance (SCF) instruments open new possibilities

Despite the fact that banks still command 80% of the global transactions marketplace, their generally traditional and low-tech approach means they often lack the flexibility and agility SMEs need to address their financing challenges. However, the demand for cross-border payment services from SMEs and the opportunities they create is not lost on those in the market – non-bank SCF instruments such as factoring, forfaiting, or payables finance are emerging to enable more economic equality and inclusivity.

What’s more, the increasing number of freight fintech solutions in the market is helping to make such SCF instruments even more accessible to SMEs to manage cash flow and the payment risks that come with overseas trade.

New freight fintech ecosystem for SMEs

SMEs’ need for digital cash management solutions increased dramatically during the pandemic due to increased volatility and virtual workplaces, a trend that is building towards an entirely new digitally-based freight ecosystem. However, the logistics and freight forwarding industries were overdue for a digital transformation long before the pandemic, and it is not traditional financial institutions leading the change, but rather an ever-growing host of fintech startups.

A McKinsey survey across industries showed that 79% of respondents planned on investing in digital supply chains. Meanwhile, one out of four companies is currently using some form of fintech in their supply chains, according to a report from CGN Global.

With regard to SMEs, awareness of these emerging B2B fintech solutions is still low, and vendors have been slow to adopt them as well. However, for those more digitally-savvy companies who seek out such solutions, there is an opportunity to close the gap in their own value chains.

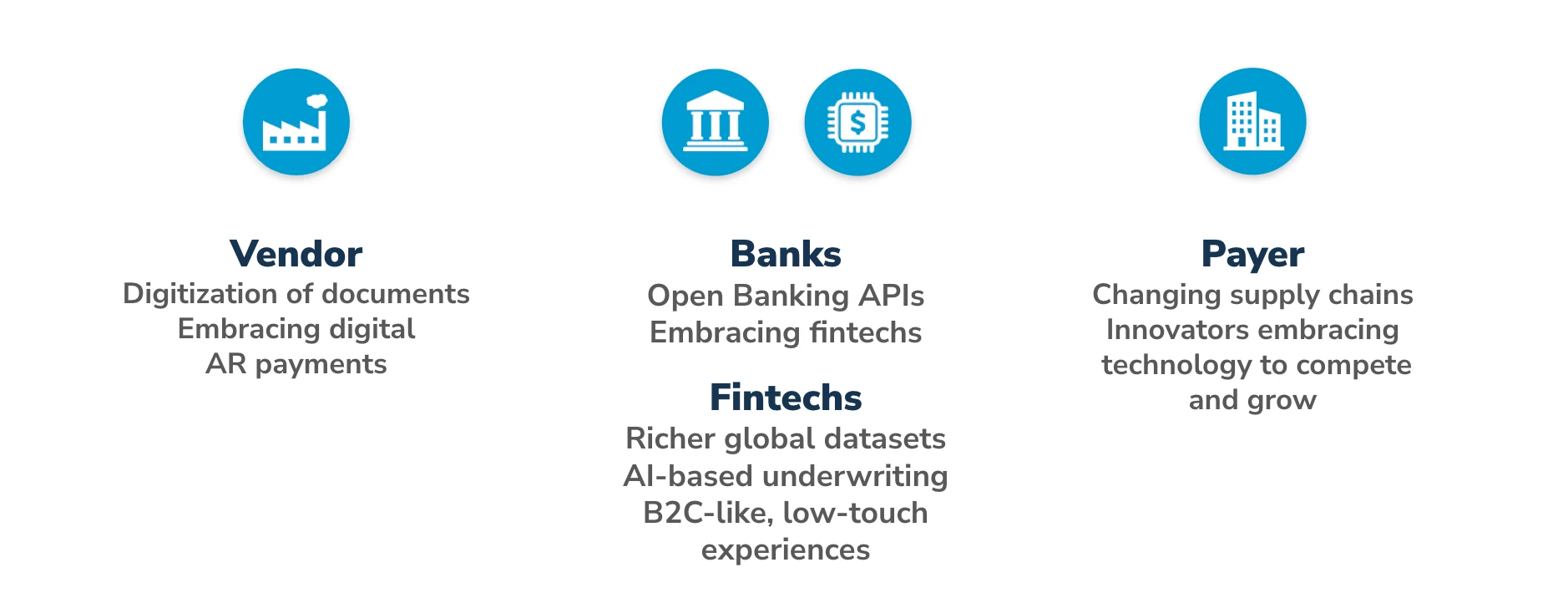

Below is a breakdown of what digital practices different players in this new freight ecosystem might adopt:

- Vendors: Digitization of documents and adoption of digital AR payments.

- Banks: Integration of open banking APIs and embracing fintechs as partners for evolved SCF services.

- Fintechs: Acquisition of richer global datasets, adoption of AI-based underwriting, and more consumer-driven, low-touch experiences.

- Payers: Innovators embracing technology to evolve supply chains to compete and grow.

The fintech needs of SMEs don’t differ greatly from those of large corporations. For example, a small-sized payer based in the US might need to make fast cross-border payments to vendors as well as require net 30/120-day terms. Meanwhile, their Asia-based vendor is focused on getting paid faster and being able to offer terms to their customers.

The kinds of support that freight fintechs provide to payers and vendors can be broken down into three categories:

- Trade Finance: financing options for international cargo movement.

- Logistics Finance: financing options for international logistics movement.

- International Payments: fast and inexpensive international payments with FX.

Below are some of the core services for SMEs that we are seeing and can expect to see more of from fintechs in the new digital freight ecosystem:

Pay-it-Later solutions to improve cash flow

As discussed above, many SMEs struggle to maintain cash flow amid the recent disruptions to the logistics industry, especially port congestion. Small-sized retailers feel the effects of blocked ports quickly and acutely, with 97% reporting that they had been impacted by the major port and shipping delays in 2021 in a National Retail Federation survey.

When ports are blocked and containers are unable to be unloaded, SMEs face detention and demurrage charges beyond their capacity to immediately cover. Thankfully, freight fintechs are now offering digital Pay-It-Later solutions to help SMEs release their ocean cargo and maintain cash flow for healthy business operations.

Blockchain for future value chain transparency

In the eyes of the tech industry, blockchain is still an early-stage technology that has yet to prove its merits in sectors such as logistics. That said, many believe that SaaS products based on distributed ledger technologies will play a vital role in the digital transformation of global supply chains, and we are seeing more and more such solutions in the market.

The benefits that blockchain services offer SMEs in turning their legacy supply chains into robust and agile value chains include:

- The use of stablecoins – or cryptocurrency designed to be relatively stable by being pegged to a commodity or currency – to enable faster and cheaper B2B payments.

- Blockchain for documentation and identity management, resulting in easier KYC (Know Your Customer) and KYB (Know Your Business) verification along with global underwriting.

- Adopting DeFi and Smart Contracts to build secured credit pools or DAOs, enabling a lower cost of capital for SMEs.

A number of multinational companies are constructing the required infrastructure to provide these kinds of decentralized logistics services as well as integrate more SMEs into their global supply chains.

For example, TradeLens is an open and neutral industry platform underpinned by blockchain technology and supported by major players in the global shipping industries, such as Maersk and Hapag-Lloyd. The platform - which runs on IBM Cloud and IBM Blockchain – has already helped multiple companies by providing a more timely and consistent view of logistics data for their containerized freight across the globe.

Additionally, Walmart Canada has recently pioneered an automated invoicing and payments system for its 70 third-party freight carriers built on top of distributed ledger technology. The system has already helped the retailer combat vast data discrepancies in the invoice and payment process for the carriers, which before required costly reconciliation efforts and caused long payment delays.

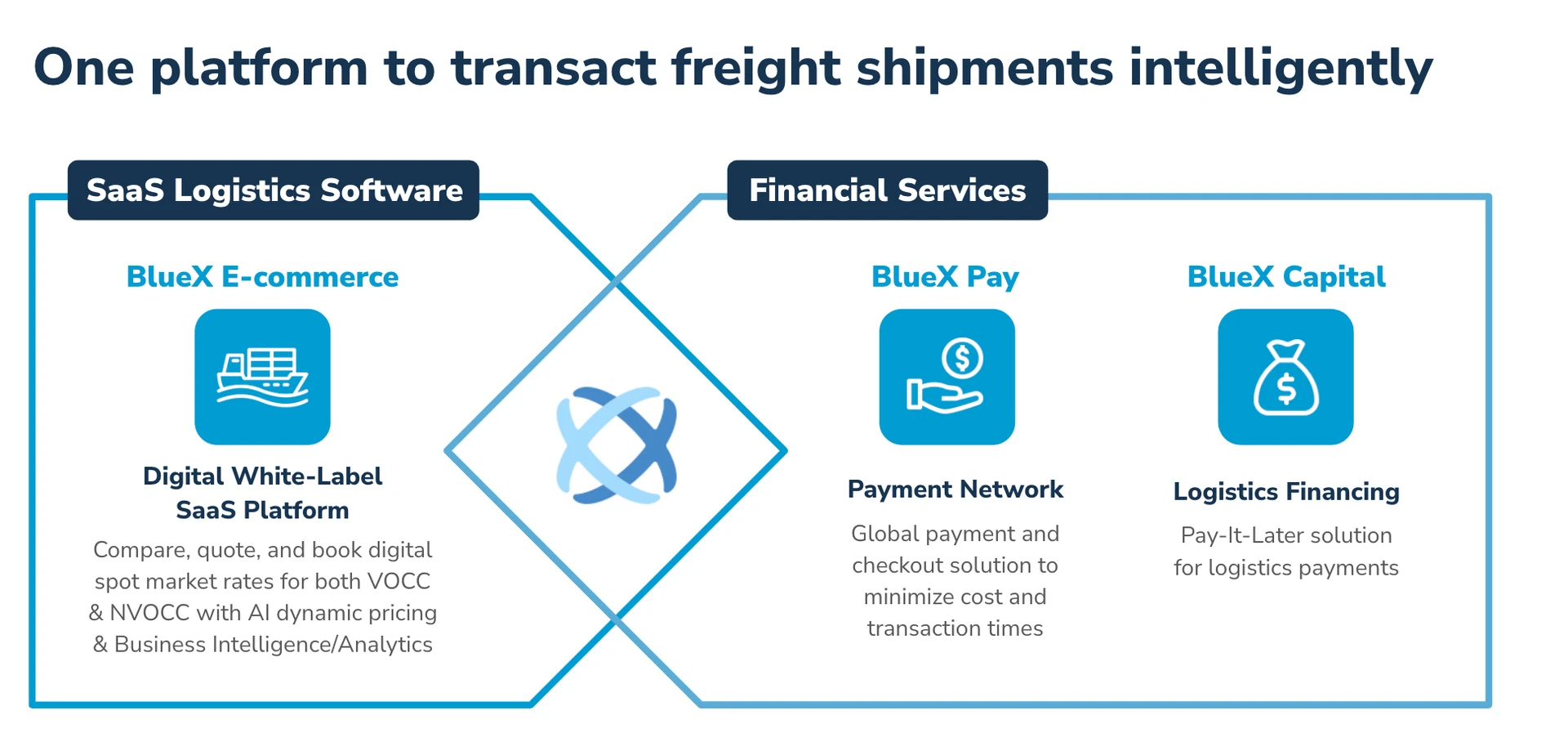

We at BlueX Pay have a deep understanding of the freight challenges that SMEs will face in 2022 and beyond, which is why we have built the premier cash flow management platform for buyers and sellers in the global logistics market.

Designing an experience focused on the supply chain, BlueX Pay enables SMEs to send and receive payments easily in-country or across borders, whether it is bank-to-bank or via digital wallets. We have also integrated a Pay-it-Later solution to help our payers and vendors better manage cash flow – especially during peak periods.

BlueX Pay-it-Later features:

- Fast access to funds: BlueX Pay-it-Later gives SMEs access to the funds they need to get cargo released faster. With our solution, SMEs buy now and pay later with net 30 to 60-day payment terms of up to US$1 million. Our customers avoid thousands of dollars in fees, receive their goods and generate revenues, and avoid cash flow problems.

- Improved supply chain health: Our all-in-one platform amplifies cash flow for buyers and sellers. Buyers get flexible pay later options and sellers get paid instantly.

- Flexible payment terms: BlueX allows SMEs to easily send and receive global payments. Even better, we pay your vendors upfront, and you pay us back 30 to 60 days later.

Get started optimizing your supply chain

BlueX Pay-it-Later is the smart capital choice for keeping your business’ shipments moving and riding out disruptive cargo problems in 2022 and beyond.

Sign up today for free with a fast registration process that doesn’t impact your credit score and gives you funds on demand, and lets you pay for what you use.

To learn more, contact us at sales@bluexpay.com