The current economic environment is less than favorable for small businesses in the US. Inflation and interest rates have at times hit new highs, and the threat of a possible recession seems to loom around the corner. Anxieties are running high for many companies as to how to remain cash flow positive when prices suddenly rise, costs of labor are increasing, and traditional lenders remain highly risk averse.

However, the good news is that new kinds of digital technology are rushing in to fill the gap left between small businesses and access to financing tools, providing those companies with higher degrees of agility and resilience to meet the challenges of today’s economy. Here, we’ll take an in-depth look at those challenges and the different fintech solutions emerging to arm small businesses against them.

In 2022, the costs of inflation and rising interest rates along with the labor shortages weighed down small businesses in every area. Nearly 40% of businesses surveyed by PYMNTS cited inflation as their biggest challenge in 2022, compared to only 23% at the beginning of that year. Areas where expenses increased included shipping, property taxes, as well as higher costs of hiring employees. According to Forbes, 57% of US small businesses had to cut costs in response to the above.

Source: PYMNTS, Forbes, US Labor Department

Labor Shortages

The enormous talent gap that the US is currently facing has left key economic policymakers with little hope for change in the coming years. Federal Reserve Chair Jerome Powell noted at a recent press conference that the US has a “structural labor shortage” that is unlikely to be resolved anytime soon. According to the US Labor Department, there is a gap of 5.5 million in the number of retail job openings in the US compared to the number of workers to fill them.

Less available workers means that businesses must offer increasingly competitive salaries to attract talent, a cost that is much harder to meet under increased inflation and interest rates. The above Forbes report cited labor as the highest cost for small businesses in 2022, representing 70% of spending.

Inventory costs

Just behind labor in the Forbes survey was inventory, which took up an average of 17 to 25% of small business spending. Inventory should generally translate into revenue in the long run, but the purchasing of inventory can be an extremely high expense for small businesses with limited working capital, especially during peak seasons when stock needs to be high.

Limited capital

Forbes listed running out of capital as the second most common reason that small businesses failed in 2022. With less access to traditional finance tools compared to larger-sized businesses, it is often a struggle for smaller companies to amass the cash they need to cover operating expenses and maintain inventory.

On the heels of a financially turbulent year, many small businesses entered 2023 with new uncertainties, particularly with regard to financing and supply chains. According to Capterra Research, supply chain professionals in small business ranked inflation (65%), lack of inventory (45%), and a possible economic recession (42%) among their top three concerns going into 2023. We’ve identified several key business trends we expect to see in 2023:

Small businesses will shorten their supply chains

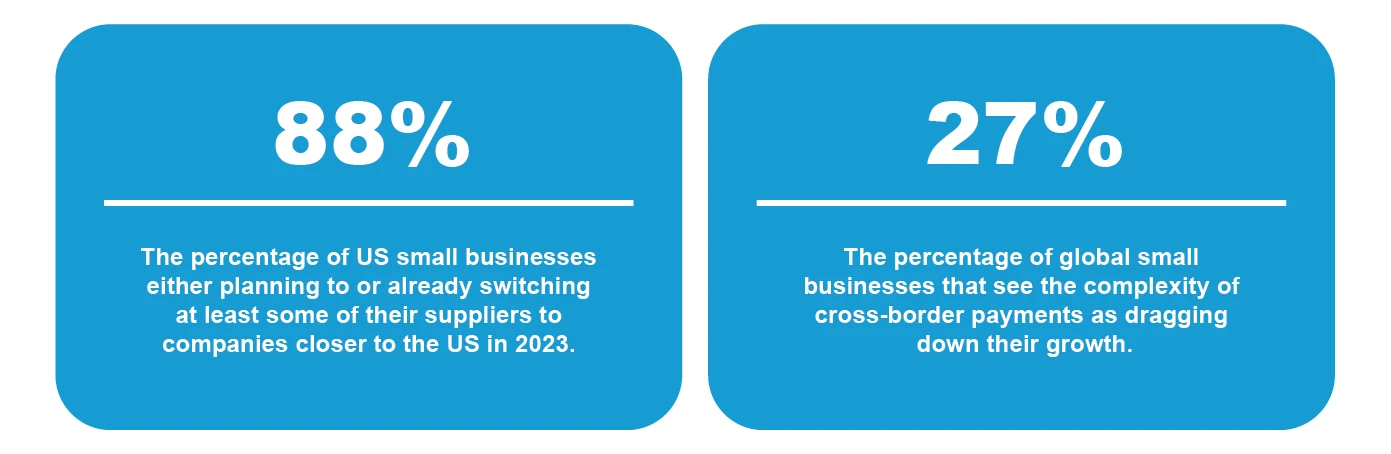

To reduce costs, more and more US small businesses are moving their supply chains closer to home. According to data from the US Chamber of Commerce, more than half of small businesses surveyed have altered their supply chains to be more reliant on local suppliers. And the Capterra Research report shows that 88% of small businesses either plan to or are already switching at least some of their suppliers to companies closer to the US in 2023.

Cross border payment challenges will continue

In line with global supply chain challenges, cross border payment systems have yet to meet the needs of small businesses, and not just those in the US. According to a joint report between PYMNTS and Payoneer, 27% of small businesses worldwide view the complexity of cross-border payments as a drag on their growth. And only 23% of those surveyed were satisfied with their current cross-border payment solutions.

Source: Capterra Research, PYMNTS & Payoneer

Source: Capterra Research, PYMNTS & Payoneer

More small businesses will look for alternative financing options

Disruptions to cash flow and a lack of traditional lender support is pushing small businesses to search for alternative and often more creative financing methods, such as invoice factoring, inventory financing, or Buy-Now-Pay-Later (BNPL) solutions. The advantages of these options usually include a lower barrier to entry along with more flexible payment terms, and fintech companies are innovating in line with demand to provide easier access to these financial tools.

Fintech platforms have already been bridging the gap between small businesses and traditional financial institutions for several years. But with inflation and interest rate hikes still going strong into 2023, we expect to see an acceleration in this trend across all sectors.

The benefits of adopting fintech are extensive. Small businesses that incorporate new payment technology platforms and modernize their AP and AR processes are more likely to see growth in their sales, profits, and employment. A total of 93% of US CFOs surveyed by PYMNTS said that they are in the process of digitizing their accounting operations. Meanwhile, more than half of the same group said that digitization has allowed them to increase use of payment types such as ACH payments, credit cards, wires, and real-time payments (RTP), among others. Businesses should continue to educate themselves on the various fintech solutions emerging and which areas of their business these tools can strengthen.

Real time payments to shorten the payment cycle

Despite the availability of new fintech solutions, numerous industries are still relying on legacy payment methods. According to Forbes data, paper checks remain the most common form of business-to-business (B2B) payments at 81%. The problem with checks is that they need to be physically mailed, which can take an average of 90 days to pay. For small businesses surviving from payment to payment, that could seem like an eternity.

Real time payments are shaking up traditional means of sending money. Simply put, RTP networks allow small businesses and their supply chain partners to get paid in real time. By significantly shortening the payment cycle, small businesses can decrease risk for their business operations.

Source: PYMNTS, Forbes, PYMNTS

Source: PYMNTS, Forbes, PYMNTS

The Forbes report states that most US businesses expect to be able to send and receive business real-time payments in 2023, and almost 50% are interested in using RTP for recurring or ad hoc payments, indicating a long developing demand for their service. The report also highlights how over 250 financial institutions in the US currently meet roughly 61% of demand deposit accounts on the RTP network.

Both banks and the US government understand the importance among businesses and individuals of processing payments instantly, which is why the Federal Reserve Bank aims to launch its instant payment service, U.S. FedNow, within 2023. The outlook is optimistic for the benefits the service can offer to small businesses.

All-in-one payment solutions for more effective cash management

Economic uncertainty is prompting an unprecedented need for smart cash management to keep businesses cash flow positive. However, many of these businesses lack the accounting manpower to optimize in this area, which is why many companies are shifting to intelligent digital cash management solutions. One example is all-in-one payment platforms.

According to PYMNTS, 40% of small businesses surveyed have already shifted to using online all-in-one payment platforms to manage their accounting, with more than 50% claiming the platforms have made cash management easier and 32% already seeing improvements in their cash flow.

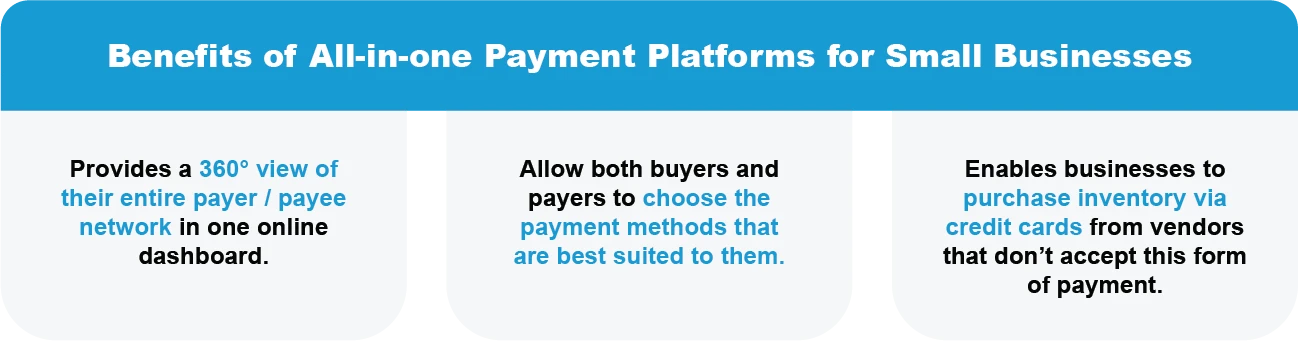

The benefits of implementing an all-in-one payment platform include:

- Businesses receive a 360° view of their entire payer / payee network in one online dashboard.

- Customization tools allow both buyers and payers to choose the payment methods that are best suited to them.

- All-in-one platforms can enable businesses to purchase inventory via credit cards from vendors that generally don’t accept this form of payment.

Data and AI for more transparent, collaborative accounting

Buyers and vendors will inevitably have their own preferences for making and receiving payments, and a lack of transparency on either side relating to payment status can lead to increased friction. That’s why capturing business intelligence throughout the AR / AP process can be crucial to overcoming these conflicts.

Beyond the visibility into payments statuses that an online platform can provide, integrating data and artificial intelligence (AI) solutions into a dashboard can help predict and prepare for future payment situations, such as which vendors are likely to pay late or when a company may need additional payroll for a busy season. What’s more, sharing this data with external payers or payees can help avoid friction for both sides as well as help prevent missed or delayed payments.

Cash flow forecasting to stay ahead of upcoming expenses

Not all operational expenses can be predicted, especially during turbulent economic times such as now. This is another scenario in which small businesses can apply business intelligence to stay prepared and to take proactive measures to ensure stable cash flow. Adding a cash flow forecasting tool to an online dashboard allows accounting to track expenses and receipts to forecast future financial health.

For example, if you require more inventory during peak seasons, a cash flow forecasting tool can use past years’ business data to give you a stronger picture of how much inventory you’ll need to buy and even identify where you can acquire it for a lower price, helping you avoid overspending. It could also help you make sure you have enough inventory so that you don’t lose any sales. Or, the tool can help you know which bills to put on hold or which invoices to pay to ensure you have enough cash to fund your employees’ payroll.

Open banking enables lender flexibility & customization

Open banking – or the sharing of financial data between banks to third parties by APIs to offer enhanced services – is still in the developmental stage in the US. However, if we look at progress in countries like the UK – the US is likely to follow suit. According to data from software firm Endava, open banking is showing strong cumulative growth in the UK, with 4.5 million regular users as of the middle of 2022, 600,000 of which were small businesses.

The need has never been greater for small businesses to be able to avail themselves of open banking services. One use case is the customization for financing solutions for borrowers: open banking allows a much higher degree of flexibility to lenders, such as repayment options that can be adapted to fit the borrower (small business) as their financial situation changes over time. This is the kind of flexibility small businesses need to navigate and weather tough financial situations.

BNPL for greater business resilience

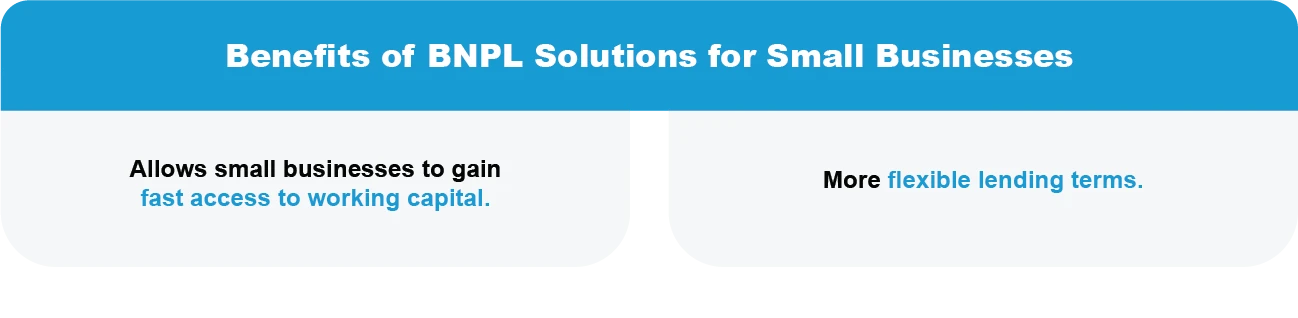

Buy-Now-Pay-Later (BNPL) solutions have seen increasing consumer adoption during the last few years due to uncertain economic conditions, and now more small businesses are taking advantage of fintech solutions providing this service. Inflation and rising interest rates can dig into companies’ cash flows and inventory, making them far more vulnerable to economic disruption. BNPL allows small businesses to gain fast access to working capital and maintain a healthy cash flow.

As a fintech company dedicated to developing alternative financing options for small businesses, BlueX has built payment platforms and Pay-it-Later solutions specifically for the kind of hurdles you may be facing at this moment.

BlueX offers an all-in-one platform designed for growing businesses who want healthier cash flows. Our solutions amplify cash flow for buyers and sellers, offering flexible pay later options and instant payments. Businesses can create one streamlined dashboard and wallet for their entire company in which transactions appear for strong visibility and easy reconciliation. Wallet-to-wallet payments arrive in one day and are processed instantly.

BlueX Pay-it-Later offers fast access to up to $1 million for your cargo and all your logistic service needs. You can get approved in less than 48 hours, and have up to 60 days to pay back your invoices. With no application or set up fees, we pay your vendors on time so you can pay later and focus on the goals that drive business growth.

Reach out to the BlueX team on how to make better payments and amplify your cash flow.